#PAYMENT GATEWAY SERVICES

Explore tagged Tumblr posts

Text

Increased Efficiency: Automation, speed, and streamlined financial tasks for better productivity.

Enhanced Security: Protect data with encryption, authentication, and robust fraud prevention.

Improved Accessibility: 24/7 access via mobile apps, online platforms, and support.

Cost Savings: Lower operational expenses and reduced transaction fees.

Data Analytics: Real-time insights, predictions, and personalized financial guidance.

Regulatory Compliance: Automated checks, real-time reporting, and adherence to changing regulations For additional information, just check out our website:- https://www.pay10.com/

#FINTECH#PAY10#PAYMENTGATEWAY#PAYMENT GATEWAY SERVICES#PAYMENT GATEWAY PROVIDER#BEST PAYMENT GATEWAY

2 notes

·

View notes

Text

Best Payment Gateway

Jamali Pay is the best payment gateway solution for company or personal use, Jamali Pay support and integrates all banks and cryptocurrencies in the world so visit now at: https://jamalipay.com

2 notes

·

View notes

Text

In a world where online commerce flourishes, acquirers must distinguish themselves by meeting merchants' evolving needs. FSS Payment Gateway offers a comprehensive solution: seamless payment processing, robust risk management, profound data insights, and versatile features catering to diverse merchant segments. Empower your business to thrive in the digital realm effortlessly.

0 notes

Text

Navigating the Maze: Choosing the Right Payment Gateway for Your Business with ClickAims

In today's digital world, seamless and secure online payments are the lifeblood of any successful business. Customers expect a smooth checkout experience, and offering a variety of payment options is crucial for conversion. But with a vast array of payment gateways and processors available, choosing the right one can feel overwhelming. ClickAims, a trusted provider of payment gateway services, is here to help you navigate the maze and find the perfect fit for your business.

Payment Gateways: The Secure Bridge Between Your Business and Customers

Think of a payment gateway as a secure bridge between your online store and your customer's bank account. When a customer makes a purchase, the payment information is encrypted and sent through the payment gateway for authorization. Once approved, the funds are transferred from the customer's account to yours.

Why Choose the Right Payment Gateway Matters

The right payment gateway can significantly impact your business in several ways:

Offering a variety of popular payment options, like credit cards, debit cards, and digital wallets, can encourage customers to complete their purchases.

Reliable payment gateways employ sophisticated security measures to protect your business from fraudulent transactions.

A smooth and secure checkout process builds trust with customers and encourages repeat business.

Integrating your payment gateway with your accounting software can automate tasks and save you valuable time.

ClickAims Can Help You Find the Perfect Payment Gateway:

With so many options available, choosing the right payment gateway can feel like a challenge. ClickAims takes the guesswork out of the process by:

We'll discuss your business model, the types of products or services you offer, and your target audience to identify the features that matter most to you.

Different payment gateways have varying fee structures. We'll help you understand these fees and find a solution that fits your budget.

If you plan to sell internationally, choosing a payment gateway that supports multiple currencies and languages is crucial. ClickAims can guide you towards solutions optimized for international transactions.

ClickAims prioritizes security. We ensure the payment gateway you choose adheres to the highest security standards and complies with relevant regulations.

Popular Payment Gateway Options:

Here's a brief overview of some popular payment gateway choices:

A widely recognized and trusted platform, ideal for businesses with a global customer base.

A user-friendly option with a transparent fee structure, perfect for startups and small businesses.

Offers a wide range of features and integrations, suitable for established businesses with complex needs.

Integrates seamlessly with Amazon accounts, ideal for businesses that sell on the Amazon marketplace.

ClickAims: More Than Just Payment Gateways

ClickAims goes beyond simply recommending a payment gateway. We offer a comprehensive suite of services to manage your online payments:

Our experienced team will seamlessly integrate your chosen payment gateway with your existing website or online store.

ClickAims can help you implement fraud prevention measures to protect your business from fraudulent transactions.

We can analyze your payment processing data and recommend strategies to optimize fees and improve efficiency.

ClickAims is here for you every step of the way, offering ongoing support and troubleshooting to ensure your payment system runs smoothly.

Choosing the Right Partner for Your Payment Needs

ClickAims understands that your business is unique, and your online payment needs will be too. We are dedicated to providing you with personalized solutions and expert guidance to ensure your online transactions are secure, efficient, and contribute to your business success.

Ready to Streamline Your Online Payments?

Contact ClickAims today for a free consultation! We'll help you navigate the world of payment gateways, answer your questions, and find the perfect solution to power your online sales and take your business to the next level. Don't let complex payment options hold you back from achieving your business goals. Let ClickAims be your trusted partner in creating a seamless and secure online payment experience for your customers.

#payment gateway services#best payment gateway for international transactions#best online payment processor for business#payment platforms for businesses#best payment processor for business#ClickAims

0 notes

Text

#fintech payment#fintech software development company#pos service provider#payment security solutions#pos app development services#payment gateway services

0 notes

Text

Payment Gateway Services | Safe Payment Processing

Securely process payments online with our payment gateway services. Our easy-to-use platform offers safe and fast payment processing for businesses of all sizes. Accept all major credit cards and more with our customizable payment solutions. Discover how our payment gateway services can benefit your business today.

0 notes

Text

Types of Payment Processing System & How does it work?

Credit Card Processing System

Credit card processing systems are the most common payment processing systems used by businesses. When a customer makes a purchase using their credit card, the payment processing system sends the transaction information to the credit card company for approval. Once approved, the payment is transferred to the merchant's account. cheapest payment gateway in india

Debit Card Processing System

Debit card processing systems work similarly to credit card processing systems, but instead of borrowing money, the customer is using their own funds. The payment processing system sends the transaction information to the customer's bank for approval. Once approved, the payment is transferred to the merchant's account.

E-Wallet Payment Processing System

E-wallet payment processing systems allow customers to store their payment information in a digital wallet. When making a purchase, the customer can simply select their preferred payment method from their e-wallet and the payment processing system will transfer the funds to the merchant's account. payment gateway for foreign currency

Mobile Payment Processing System

Mobile payment processing systems allow customers to make payments using their mobile devices. These systems use near-field communication (NFC) technology to transfer payment information from the customer's device to the merchant's payment processing system. merchant payment gateway india

ACH Payment Processing System

ACH payment processing systems allow businesses to accept payments directly from a customer's bank account. The payment processing system sends the transaction information to the customer's bank for approval. Once approved, the payment is transferred to the merchant's account. free payment gateway india

Cryptocurrency Payment Processing System

Cryptocurrency payment processing systems allow customers to make payments using digital currencies such as Bitcoin. These systems use blockchain technology to securely transfer payment information from the customer's digital wallet to the merchant's payment processing system. third party payment gateway india

Overall, payment processing systems work by securely transferring payment information from the customer to the merchant's payment processing system, which then sends the transaction information to the appropriate financial institution for approval and transfer of funds. payment gateway international india

#online payment#credit card#payment gateway services#digital wallets#payment processing#payment integration#international payments process#mastercard#payment gateway#payments#payout#payment request#accepting payments

0 notes

Text

Join Wise and get £50. It's simple, quick, and rewarding!

Wise Money, Wise choices!

Looking for a smarter way to handle your money across borders? Wise.com is the answer. And here’s an even better reason to join—sign up with my invite, and you’ll get £50!

Smart Transfers, Happy Wallets!

Wise.com makes sending, receiving, and converting money internationally fast, easy, and affordable. With real exchange rates and low fees, you’ll save more on every transaction. Plus, their platform is user-friendly, so you can manage your money with confidence.

Save More, Send Smarter!

Signing up is simple. Just use my invite link, create your account, and you’ll get £50 to kickstart your journey with Wise. It’s a win-win—secure your bonus and start saving today!

Your Money, Your Way—Easily!!!

#payment gateway#payment gateway for website#what is a payment gateway#best payment gateway#white label payment gateway#online payment gateway#what is payment gateway#own payment gateway#create payment gateway#cashfree payment gateway#money transfer#wire transfer#transfer payments#wise transfer#transfer money#payments#wise money transfer#transfer#paypal transfer#money transfer service#transfer payments economics#payment#transferwise money transfer#transfer payments macroeconomcis#bank transfer#how to transfer money#paypal instant transfer#neft transfer#transfer money from stripe to bank#transferwise money transfer review

2 notes

·

View notes

Text

#eCheck#Electronic checks#ACH (Automated Clearing House)#Digital payments#Payment processing#Merchant services#Payment solutions#Secure transactions#Business payments#Online payments#Payment gateway#Payment technology#Financial services#E-commerce#Retail business#Small business#USA businesses#American merchants#Payment methods#Payment processing company#Payment processing solutions#Electronic payment options#Payment security#Card processing#Payment terminals#Mobile payments#Payment software#Point of sale (POS)#Payment integration#Business growth

7 notes

·

View notes

Text

India's evolving digital payment landscape, governed by RBI and NPCI, offers diverse opportunities for financial inclusion, convenience, and innovation amid challenges.

#best payment gateway#bestpaymentgatewayinindia#pay10#payment gateway services#payment gateway provider#bestpaymentgatewayservicesproviderinindia#paymentgateway#bestpaymentgateway

0 notes

Text

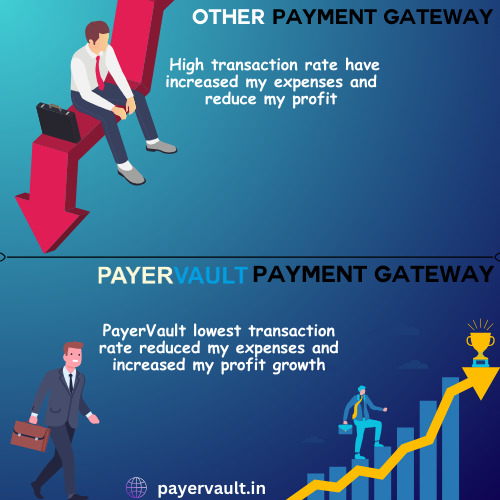

Ready to revolutionize your business's online transactions? Payervault offers seamless payment solutions at the lowest charges. Get started today! 💻💳 #Payervault #PaymentGateway #OnlineBusiness" Visit the website to learn more- https://payervault.in/

#finance#payments#payment solutions#business consulting#payment gateway#payment collection#paying#payouts#payment processing#payment services#payment systems#ecommerce#online#online shops offer#online store#online shopping#small business

3 notes

·

View notes

Text

WHMCS Service Provide By WHMCS DADDY

Are you looking for the best services for the Whmcs module and themes? WHMCS Daddy is presenting an extensive collection of Worldwide Custom WHMCS Development Services! So, Please visit our website and great information for our customers. Our WHMCS Development Services Company brings much more facilities. For more information, contact us at 90411 74652, and enjoy our services.

#WHMCS Development Services Company#Clients Password changes in WHMCS#whmcs module development#whmcs theme development#cardconnect payment gateway whmcs#whmcs payment gateway module

2 notes

·

View notes

Text

Why TDS Online Payment is Important & How It Benefits Taxpayers

Tax credits in the source (TDS) are a critical part of India’s tax system. This ensures that taxes are collected in advance from income sources such as salary, interest, rent, and professional fees. For digital transformation, TDS Online payment is a simple and efficient way to meet your tax obligations. Platforms like Wegofin make this process even smoother, ensuring accuracy and timely payments. Let’s look at why online payments with TDS are essential and how taxpayers can benefit.

0 notes

Text

Simplify Online Transactions with Payment Gateway Services

Experience seamless and secure online transactions with our comprehensive payment gateway services. Our advanced payment solutions are designed to streamline the payment process, ensuring a smooth checkout experience for your customers. With robust features, including multi-currency support, fraud prevention tools, and real-time transaction monitoring, our payment gateway services provide the reliability and security your business needs.

0 notes

Text

In today’s competitive market, businesses strive to enhance their credibility and expand their reach. One way to achieve this is through Zed certification, a government-backed initiative that promotes quality, sustainability, and efficiency in manufacturing. This certification, particularly beneficial for Micro, Small, and Medium Enterprises (MSMEs), provides recognition for companies that meet high operational standards. Read.

#legal#tax#legal services#zed certification#msme zed certification#STPI registration#Apply for stpi registration#DSC registration#DSC registration online#payment gateway license#payment gateway registration

0 notes

Text

Renting vs. Buying Credit Card Terminals: Which Is Right for You?

Credit card processing has become a fundamental aspect of any merchant's operations. Whether you are a small business or a high-risk merchant, accepting credit cards is essential for ensuring customer satisfaction and improving sales. One of the key decisions you’ll need to make is whether to rent or buy a credit card terminal. This decision can have a significant impact on your business's credit card processing fees, upfront costs, and long-term financial commitments.

#merchant services#merchant service provides#high-risk merchants#merchant services in USA#Credit Card Terminals#Credit card processing#high-risk merchant#rent or buy a credit card terminal#credit card processing fees#high-risk payment gateways

0 notes